GC Division – Classifying Trades in the Repo Market using Machine Learning Techniques

GC Division – Classifying Trades in the Repo Market using Machine Learning Techniques

By Dr Marian Priebe, Quantitative Analyst, London Reporting House

Summary

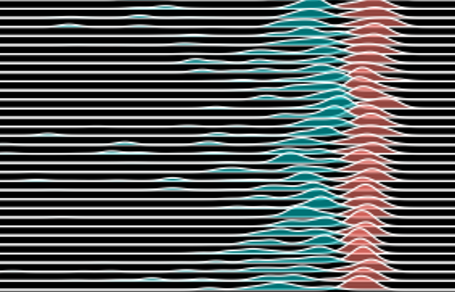

London Reporting House (LRH) has access to Securities Financing Transactions Regulation (SFTR) data that is otherwise only available to regulators. This allows us to build a clearer picture of activity in the European repo market than individual participants. One particular point of interest is the division of the repo market into cash-driven and collateral-driven transactions, that is, between so-called “general collateral” or GC repo and “specials.” Since GC repo is cash-driven, it should trade at or around a fixed repo rate - the GC repo rate. Special repo is securities-driven and trades at a wider range of different rates which depend on the intrinsic value of the collateral security. This intrinsic value drives special repo rates lower than the GC repo rate…

Please register using the form below to read the white paper in full.

"*" indicates required fields